TABLE OF CONTENTS

GREEN CENTURY BALANCED FUND

GREEN CENTURY EQUITY FUND

GREEN CENTURY MSCI INTERNATIONAL INDEX FUND

114 State Street, Suite 200

Telephone: 1-800-93-GREEN (1-800-934-7336)

NOTICE OF SPECIAL MEETING

To be held

SeptemberJune 22,

20142021

A Special Meeting of Shareholders of the Green Century Balanced Fund (the Balanced Fund)

and, the Green Century Equity Fund (the Equity Fund)

and the Green Century MSCI International Index Fund (the

International Fund) (the Green Century Funds or the Funds)

willis scheduled to be held at the office of Green Century Capital Management, Inc., 114 State Street, Boston, MA 02109, on

SeptemberJune 22,

2014 at 3:2021at 10:00

p.m.a.m., Eastern Time, for the purposes listed below.

If we decide to hold a meeting at a different time or in a different location, we will make an announcement in the manner discussed in these materials. | | |

| Proposal 1. |

| To elect Trustees of the Funds. |

| |

| Proposal 2. |

| To transact such other business as may properly come before the Special Meeting of Shareholders and any adjournments or postponements of the Special Meeting. |

The Board of Trustees of the Funds recommends that you vote

in favor of all Proposals.“FOR” Proposal 1.

Only shareholders of record on

July 22, 2014March 31, 2021 will be entitled to vote at the Special Meeting of Shareholders and at any adjournments

or postponements thereof.

| | | Amy Puffer, Secretary |

Kristina Curtis, President |

| | | Green Century Funds |

April 8, 2021

August 12, 2014

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE SHAREHOLDER MEETING TO BE HELD ON

SeptemberJune 22,

2014:2021: This Notice, the Proxy Statement and the Funds’ most recent Annual Report to shareholders are available on the internet at

http://greencentury.com/forms-documents/.

YOUR VOTE IS IMPORTANT. If you promptly vote, sign and return the enclosed proxy card(s), you will help avoid the additional expense of a second solicitation. The enclosed addressed envelope requires no postage and is provided for your convenience. You may also vote by calling the toll-free number on the proxy card, or visiting the web site address listed on the proxy card.

TABLE OF CONTENTS

iii

GREEN CENTURY BALANCED FUND

GREEN CENTURY EQUITY FUND

GREEN CENTURY MSCI INTERNATIONAL INDEX FUND

114 State Street, Suite 200 Telephone: 1-800-93-GREEN (1-800-934-7336)

This Proxy Statement is being furnished to you in connection with the solicitation of proxies by the Board of Trustees of the Green Century Balanced Fund (the Balanced Fund)

and, the Green Century Equity Fund (the Equity Fund)

and the Green Century MSCI International Index Fund (the

International Fund) (the Green Century Funds or the Funds) for use at a Special Meeting of Shareholders of the Funds, or any adjournment thereof,

scheduled to be held at the offices of Green Century Capital Management, Inc. (Green Century), 114 State Street, Boston, MA 02109, on

SeptemberJune 22,

20142021 at

3:10:00

p.m.a.m., Eastern Time, for the purposes set forth in the accompanying Notice of Special Meeting. You may call Green Century at 1-800-93-GREEN (1-800-934-7336) for information on how to obtain directions to attend the meeting and vote in person.

The Funds’ Annual Report for the fiscal year ended July 31,

2013,2020, including audited financial statements, and Semi-Annual Report for the fiscal period ended January 31,

2014,2021, have previously been sent to shareholders and are available without charge by written request to Green Century Capital Management, Inc., 114 State Street, Suite 200, Boston, MA 02109, by calling 1-800-93-GREEN (1-800-934-7336), by emailing info@greencentury.com or by downloading the report from our website at

http://greencentury.com/forms-documents/.

This Proxy Statement

is divided into the following four parts: | | | | |

Part 1. | | Overview. | | Page 2 |

| | |

Part 2. | | Information Regarding Voting and the Special Meeting. | | Page 2 |

| | |

Part 3. | | The Proposal. | | Page 4 |

| | |

Part 4. | | Information Regarding the Funds. | | Page 14 |

This Proxy Statement wasand enclosed proxy cards were first mailed to shareholders on or about August 12, 2014.April 8, 2021.

TABLE OF CONTENTS

The Board of Trustees of the

Balanced Fund and the Equity FundGreen Century Funds has called a Special Meeting of Shareholders for the purposes described in the accompanying Notice of Special Meeting and as summarized below. The purpose of this Proxy Statement is to provide you with additional information regarding the proposal to be voted on at the Meeting and to request your vote in favor of the proposal.

The Funds are open-end management investment companies, or mutual funds. The Balanced Fund seeks capital growth and income from a diversified portfolio of stocks and bonds which meet the Green Century Funds’ standards for corporate environmental responsibility. The Equity Fund is an index fund whose investment objective is to achieve long-term total return which matches the performance of an index comprised of stocks of companies selected based on environmental, social and governance criteria.

The Green Century MSCI International Index Fund seeks to achieve long-term total return which matches the performance of an index comprised of the stocks of foreign companies selected based on environmental, social and governance criteria.

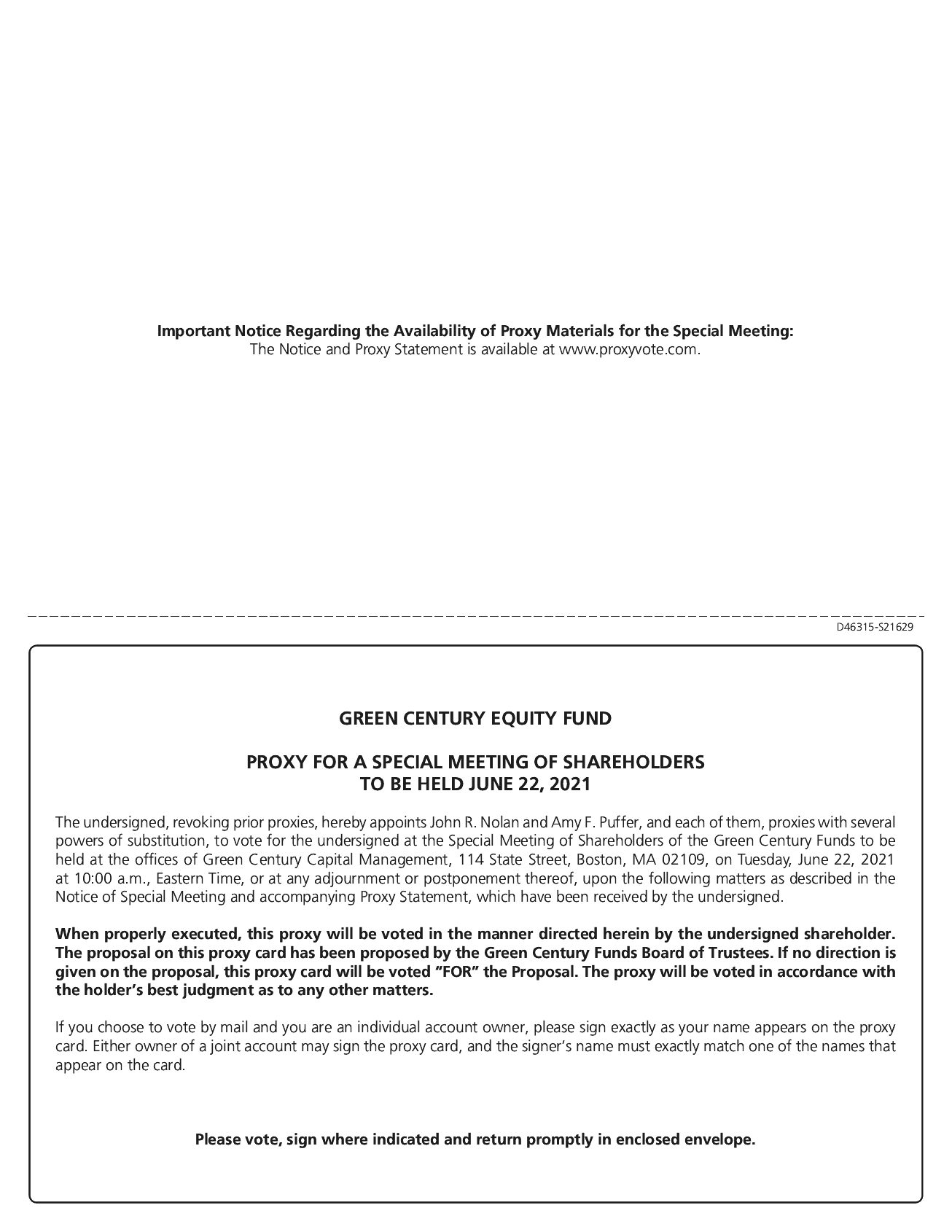

Shareholders are being asked to elect

John Comerford, Jonathan Darnell,

Laurie Moskowitz,Daniel S. Kern, Peter D. Kinder, Douglas H. Phelps,

Bancroft R. Poor,Sanford Pooler, Mary Raftery, James H. Starr,

Thomas Subak and Wendy Wendlandt as Trustees of the Funds (each, a “Nominee” and collectively, the “Nominees”). Mses. Raftery and Wendlandt and Messrs.

Comerford,Darnell, Kern, Kinder, Phelps

Poor and Starr are currently Trustees of the Funds. This Proposal is discussed in more detail under Part 3 of this Proxy Statement.

PART 2. INFORMATION REGARDING VOTING

You can vote in any one of the following ways:

By mail, by filling out and returning the enclosed proxy card(s);

By telephone, by dialing the toll-free number listed on the proxy card(s);

Online, by visiting the web site address listed on the proxy card(s); or

In person atAt the Meeting.

TABLE OF CONTENTS

Whichever method you chose to vote, please carefully read this Proxy Statement, which describes in detail the proposal upon which you are asked to vote.

You will be entitled to cast one vote for each dollar and fraction of a dollar of net asset value of the Fund share class you hold (number of shares and fractions of shares owned multiplied by the net asset value per share). The votes of the shareholders of the Balanced Fund, the Equity Fund and the EquityInternational Fund will be tabulatedtogetherfor the proposal.

All properly executed proxies received prior to the Meeting will be voted at the Meeting. On the matters coming before the Meeting as to which a shareholder has specified a choice on that shareholder’s proxy, the shares will be voted accordingly.

Even if you plan to attend the Meeting, please sign, date and return EACH proxy card you receive. Alternatively, if you vote by telephone or over the Internet, you will be asked to enter a unique code that has been assigned to you, which is printed on your proxy card(s). This code is designed to confirm your identity, provide access into the voting sites and confirm that your instructions are properly recorded.

If you hold your shares directly (not through a broker-dealer, bank or other financial institution), and if you return a signed proxy card that does not specify how you wish to vote on Proposal 1, your shares will be voted in favor of all of the nominees.

Abstentions and “broker non-votes” (shares held by brokers or nominees, typically in “street name,” as to which proxies have been returned but (a) instructions have not been received from the beneficial owners or persons entitled to vote and (b) the broker or nominee does not have discretionary voting power on a particular matter) generally are included for purposes of determining whether a quorum is present at a shareholder meeting, but are not treated as votes cast at such meeting. However, because the Funds understand that a broker or nominee may exercise discretionary voting power with respect to Proposal 1, and there are no other proposals expected to come before the Meeting for which a broker or nominee would not have discretionary voting authority, the Funds do not anticipate that there will be any “broker non-votes” at the Meeting.

Broker-dealer firms holding shares of a Fund in “street name” for the benefit of their customers and clients will request the instructions of such customers and clients on how to vote their shares on the Proposal before the Meeting. A signed proxy card or other authorization by a beneficial owner of Fund shares that does not specify how the beneficial owner’s

TABLE OF CONTENTS

shares should be voted on Proposal 1 may be deemed an instruction to vote such shares in favor of all of the nominees. With respect to routine matters such as Proposal 1, if a beneficial owner fails to provide voting instructions by the date specified in a broker-dealer firm’s proxy solicitation materials, the Trust understands that the broker-dealer firm may exercise discretionary voting power with respect to Proposal 1 on behalf of such beneficial owner.

If you hold shares of a Fund through a bank or other financial institution or intermediary (called a service agent) that has entered into a service agreement with the Fund or a distributor of the Fund, the service agent may be the record holder of your shares. At the Meeting, a service agent will vote shares for which it receives instructions from its customers in accordance with those instructions. A signed proxy card or other authorization by a shareholder that does not specify how the shareholder’s shares should be voted on the Proposal may be deemed to authorize a service agent to vote such shares in favor of the nominees. Depending on its policies, applicable law or contractual or other restrictions, a service agent may be permitted to vote shares with respect to which it has not received specific voting instructions from its customers. In those cases, the service agent may, but may not be required to, vote such shares in the same proportion as those shares for which the service agent has received voting instructions.

If you beneficially own shares that are held in “street name” through a broker-dealer or that are held of record by a service agent and you do not give specific voting instructions for your shares, they may not be voted at all or, as described above, they may be voted in a manner that you may not intend. Therefore, you are strongly encouraged to give your broker-dealer or service agent specific instructions as to how you want your shares to be voted.

If you receive more than one proxy card, please vote each proxy card separately, either by returning each card via mail or by voting each card on the toll-free number or online. You may receive more than one proxy card if you hold shares in more than one account in the

Funds and/or if you hold shares in more than one of the Green Century Funds. To vote all your shares and accounts, please vote each of the proxy cards you receive.

If you return your proxy and fail to provide instructions as to how to vote your shares with respect to the proposal, your shares will be voted FOR the proposal.

TABLE OF CONTENTS

The close of business on

July 22, 2014 wasMarch 31, 2021was fixed as the Record Date for the determination of shareholders entitled to vote at the Meeting.

5,103,512.4398,798,752.131 shares of the Balanced Fund

Individual Investor Share Class (par value $0.01 per share), 2,057,932.010 shares of the Balanced Fund Institutional Share, Class (par value $0.01 per share), 4,835,846.017 shares of the Equity Fund Individual Investor Share Class (par value $0.01 per share), 2,287,130.382 shares of the Equity Fund Institutional Share Class (par value $0.01 per share), 2,871,564.893 shares of the International Fund Individual Investor Share Class (par value $0.01 per share) and

3,138,277.3566,914,758.791 shares of the

EquityInternational Fund

Institutional Share Class (par value $0.01 per share) were outstanding as of the close of business on the Record Date.

Holders of a majority of the

voting power of the shares of each Fund

outstandingentitled to vote on the Record Date constitute a quorum and must be present in person or represented by proxy at the Meeting for purposes of voting on the proposal. Your shares will be represented by proxy at the Meeting if you vote by mail, by telephone, or online.

Regardless of how you vote (“

For”For All”,

“Against”“Withhold All” or

“Abstain”“For All Except”), your shares will be counted for purposes of determining the presence of a quorum. In addition,

abstentions and broker “non-votes”

(that is shares held by brokers or nominees as to which (a) instructions have not been received from the beneficial owner or other persons entitled to vote and (b) the broker or nominee does not have discretionary power to vote on a particular matter) will be countedgenerally are included for purposes of determining the presence of a

quorum.quorum at a shareholder meeting.

With respect to the election of Trustees, nominees must be elected by a plurality of the votes cast in person or by proxy at the meeting at which a quorum exists. Abstentions and broker “non-votes” are not considered “votes cast” and therefore, do not constitute a vote “For” the proposal. Thus, abstentions and broker “non-votes” will have no effect on the voting for the election of Trustees in the proposal because only “for” votes are considered in a plurality voting requirement.

As noted above because the Funds understand that a broker or nominee may exercise discretionary voting power with respect to Proposal 1, and there are no other proposals expected to come before the Meeting for which a broker or nominee would not have discretionary voting authority, the Funds do not anticipate that there will be any “broker non-votes” at the Meeting.

TABLE OF CONTENTS

You may revoke your proxy at any time prior to the Meeting (or any adjournment

or postponement thereof) by putting your revocation in writing, signing it and either delivering it to the Meeting or sending it to Amy F. Puffer, Secretary of the Green Century Funds, 114 State Street, Suite 200, Boston, MA 02109.

If you hold shares through a bank or other intermediary, please consult your bank or intermediary regarding your ability to revoke voting instructions after such instructions have been provided. You may also revoke your proxy by voting

in person at the Meeting.

Adjournments and Postponements

If sufficient votes in favor of the proposal are not received, the persons named as proxies may propose one or more adjournments of the Meeting to permit further solicitation of proxies with respect to the proposal. An adjournment or postponement of the Meeting will suspend the Meeting to another time. Any such adjournment will require the affirmative vote of a majority of those shares voted at the Meeting. If you voted in favor of the proposal or failed to provide instructions as to how to vote your shares with respect to the proposal (including broker non-votes), the persons named as proxies will vote your shares in favor of the adjournment of the Meeting with respect to the proposal. If you voted against or abstained from voting on the proposal, the persons named as proxies will vote your shares against any such adjournment.

Any proposal for which sufficient favorable votes have been received by the time of the Meeting may be acted upon and considered final regardless of whether the Meeting is adjourned to permit the additional solicitation of proxies with respect to another proposal. The Meeting may be postponed prior to the Meeting. If the Meeting is postponed, the Fund will give notice of the postponement to shareholders. If we decide to hold the Meeting at a different time or in a different location, we will announce any such updates by means of a press release, which will be posted on our website at www.greencentury.com. An announcement will also be filed with the Securities and Exchange Commission via its EDGAR system. In the event of any inconsistency between this proxy statement and the Funds’ governing documents or applicable law, the Funds’ governing documents and applicable law will control.

The cost of soliciting proxies (which is expected to be approximately $25,000), including the fees of a proxy soliciting agent (which are expected to be approximately $20,000)$122,000), will be borne by Green Century Capital Management, not the Funds. Green Century Capital Management has entered into a contract with Broadridge Investor Communication Solutions, Inc. to provide proxy services which will include printing and distributing this Proxy Statement and proxy cards to the Funds’ shareholders, providing the means by

TABLE OF CONTENTS

which shareholders may vote (mail, telephone, internet), tabulating the results of the votes and additional solicitation services.

In addition to solicitation by mail and the proxy soliciting agent, proxies may be solicited by the Board of Trustees, officers, and regular employees and agents of the Funds and Green Century without compensation. Green Century may reimburse brokerage firms and others for their expenses in forwarding proxy materials to the beneficial owners and soliciting them to execute the proxies.

By voting as soon as you receive your proxy materials, you will help reduce the cost of additional mailings and other solicitations, which may include telephone calls to shareholders for the purpose of reminding shareholders to vote.

TABLE OF CONTENTS

PART 3. THE PROPOSAL.

Proposal 1. To elect Trustees of the Funds.

| To elect Trustees of the Funds. |

You are being asked to elect a Board of Trustees of the Funds. The nominees for the Board of Trustees are

John Comerford, Jonathan Darnell,

Laurie Moskowitz,Daniel S. Kern, Peter D. Kinder, Douglas H. Phelps,

Bancroft R. Poor,Sanford Pooler, Mary Raftery, James H. Starr,

Thomas Subak and Wendy Wendlandt (each, a “Nominee” and collectively, the “Nominees”). Mses. Raftery and Wendlandt and Messrs.

Comerford,Darnell, Kern, Kinder, Phelps

Poor and Starr are currently Trustees of the Funds.

The Funds do not hold annual shareholder meetings for the purpose of electing Trustees, and Trustees are not elected for fixed terms. This means that each Trustee will be elected to hold office until his or her successor is elected or until he or she retires, resigns, dies or is removed from office. Mr.

Comerford was appointed by the Board in 2005 andDarnell was elected by shareholders in

2006.2014. Mr. Phelps was appointed by the Board in 1997 and was elected by shareholders in

2006.2006 and 2014. Ms. Raftery was appointed by the Board in 2009 and was elected by shareholders in 2014. Ms. Wendlandt and Mr. Starr were elected by the initial shareholder of the Funds in 1991 and by all shareholders in

2006. Ms. Raftery was2006 and 2014. Messrs. Kern and Kinder were appointed by the Board in

20092015 and

hashave not been elected by shareholders. Mr.

Poor was appointed byPooler and Mr. Subak were nominated to the Board in

20142021 and

hasthey have not

been elected by shareholders.previously served as Trustees of the Funds. Each of the Nominees has consented to being named in this Proxy Statement and to serving on the Board if elected.

Unlike the majority of mutual funds, the Green Century Funds do not pay their Trustees any fees; all the Trustees serve as volunteers.

Each of the Trustees is committed to furthering sustainable and impact investing and advocacy for greater corporate environmental responsibility.

TABLE OF CONTENTS

Trustee Nominee and Officer Information

The table below sets forth each Nominee’s name, age, position and length of service with the Funds, each Nominee’s principal occupation during the past five years, and any other directorships held by each Nominee. The address for each Nominee is 114 State Street, Suite 200, Boston, MA 02109.

Name and Age | | | Position(s)

Held with

the FundsTrust and

and Length of

of Time

Served | | | Principal

Occupation(s)

During

Past Five5 Years | | | Other

Held During

Past 5 Years | | | Number of

Funds in

Green

Century

Family of

Funds

Overseen

by NomineeTrustee |

Independent Trustees*:

| | | | | | | | |

| | | | |

Age: 5461 | | | Trustee Nomineesince 2014 | | | Managing Director, AltEnergy, LLC,

an investment firm (since 2016); Managing Director, Pickwick Capital Partners (since 2014); President/Founder, Patolan Partners, an advisory and investments firm (since 2011). | | | None | | | 3 |

| | | | | | | | | | | | |

Daniel S. Kern

Age: 59 | | | Trustee since 2015 | | | Chief Investment Officer, TFC Financial Management (since 2015); Vice President Morgan Stanley, Private Wealth Management Group, (2004-2011)and Chief Investment Officer, Advisor Partners (2011 - 2015). | | Advisory | Board member, CardioReady LLC; Board member, Voices for Progress.Wealthramp (since 2015) | | 2 | 3 |

| | | | | | | | | | | | |

Laurie Moskowitz

Peter D. Kinder

Age: 4974 | | | Trustee Nomineesince 2015 | | Senior Director, Campaigns, US & Canada, The ONE Campaign (since 2011); Founder and Principal Partner, FieldWorks (2001-2011). | Retired | None | | 2 |

None | | | | | | | | 3 |

| | | | | | | | | | | | |

Sanford Pooler

Age: 64 | | | Trustee Nominee | | | Deputy Town Manager/Finance Director, Town of Arlington, MA (since 2016); Finance Director, Town of Amherst, MA (2011 – 2016) | | | None | | | 3 |

| | | | | | | | | | | | |

TABLE OF CONTENTS

Bancroft R. Poor

Age: 58

| | Trustee

since 2014

| | Vice President for Operations/Chief Financial Officer/Assistant Treasurer, Massachusetts Audubon Society (since 1994) | | Trustee and Chair of Finance and Administration Committee, the Quebec Labrador Foundation (since 2007); Director and Treasurer of US Offshore Wind Collaborative (2010-2013). | | 2 |

| | | | |

Age: 4956 | | | Trustee since 2009 | | | Senior Advisor, Funder Collaborations, ClimateWorks Foundation (since 2014); Organizational Development Consultant, Self-employed (since 2007); Director of Major Donor Development and Special Projects, BlueGreen Alliance (2011-2012); Chief Operating Officer, Apollo Alliance (2007-2011). | | None | None | 2 |

| | | | | | | | | 3 |

Name and Age

| | Position(s)

Held with

the Funds

and Length

of Time

Served

| | Principal Occupation(s)

During Past Five Years

| | Other

Directorships

Held

| | Number of

Funds in

Green

Century

Family of

Funds

Overseen

by Nominee | | | | |

| | | | |

Age: 6673 | | | Independent Chairperson since 2009,2009; Trustee since 1991 | | Senior Attorney, Starr and Associates, PC | Retired (since 1982)2018); County Commissioner, Gunnison County, CO (1999-2010).Consultant, Rainville Petito, PLLC (2016 - 2018); Consultant, Danielson Rainville Attorneys, PLLC (2015) | | | Director and President, Gunnison Valley Housing Foundation (since 2011); Director (since 2011) and Vice President Cool(2015-2018), Coal Creek Watershed Commission (since 2011); Chairperson, Gunnison Valley Transportation Authority (2004-2010); President, Peanut Mine, Inc. (2002-2012); Director and Secretary, Crested Butte Land Trust (1991-2009). | | 2 | 3 |

| | | | | | | | | | | | |

Interested Trustees**:

Thomas Subak

Age: 57 | | | Trustee Nominee | | | Independent Consultant, Tom Subak LLC (since 2020); Independent Consultant and Chief Partnership Officer, Catchafire, a non-profit organization

(2019 – 2020); Chief Strategy Officer and Assistant to the President, Planned Parenthood Federal of America (2016 – 2018) | | | None | | | 3 |

| | | | | | | | | | | | |

John Comerford

Age: 45

Interested Trustees:** | | Trustee since 2005 | | Member, Board of Directors, BATS Global Markets (since 2011); Executive Managing Director, Instinet (since 2007). | | None | | 2 |

| | | | | | | | | |

Name and Age

| | Position(s)

Held with

the Funds

and Length

of Time

Served

| | Principal Occupation(s)

During Past Five Years

| | Other

Directorships

Held

| | Number of

Funds in

Green

Century

Family of

Funds

Overseen

by Nominee |

| | | | |

Age: 6673 | | | Trustee since 1997 | | | President (1996-2003) and DirectorCEO, The Public Interest Network (since 1996),1982) | | | Director, Green Century Capital Management, Inc.; President (since 1996) | | | 3 |

TABLE OF CONTENTS

Age: 5259 | | | Trustee since 1991 | | | President (2006-2013) and Director (since 2006), Green Century Capital Management, Inc.; Senior Vice President and Political Director, The Public Interest Network (since 1989); Senior Staff, CenterFund for the Public Interest Research (since 1989); Acting Director, Fair Share (since 2012); President, Environment America Research(since 2020). | | | None | | | 3 |

*

| A Trustee is deemed to be an “Independent Trustee” to the extent the Trustee is not an “interested person” of the Funds as that term is defined in the Investment Company Act of 1940, as amended (the “1940 Act”). |

**

| A Trustee is deemed to be an “Interested Trustee” to the extent the Trustee is an “interested person” of the Funds as defined in the 1940 Act. Mr. Phelps is considered to be an Interested Trustee by virtue of his positions as a Director of Green Century and Policy Center (since 2007). | | None | | 2with the Public Interest Network. Ms. Wendlandt is considered to be an Interested Trustee by virtue of her positions as a Director of Green Century and with the Public Interest Network. The table below sets forth each Officer of the Funds’, name, age, position and length of service with the Funds and principal occupation during the past five years. The address for each Officer is 114 State Street, Suite 200, Boston, MA 02109. |

* A Trustee is deemed to be an “Independent Trustee” to the extent the Trustee is not an “interested person” of the Funds as that term is defined in the Investment Company Act of 1940, as amended (the “1940 Act”).

** A Trustee is deemed to be an “Interested Trustee” to the extent the Trustee is an “interested person” of the Funds as defined in the 1940 Act. Mr. Comerford is considered to be an Interested Trustee by virtue of his position with Instinet, a broker-dealer that may conduct business with each Fund’s subadviser. Mr. Phelps is considered to be an Interested Trustee by virtue of his positions as a Director of Green Century and with the Public Interest Network. Ms. Wendlandt is considered to be an Interested Trustee by virtue of her positions as a Director of Green Century and with the Public Interest Network.

The table below sets forth each Officer of the Funds, her name, age, position and length of service with the Funds and principal occupation during the past five years. The address for each Officer is 114 State Street, Suite 200, Boston, MA 02109.

Name and Age | | | Position(s) Held with

the Funds and Length

of Time Served | | | During Past Five Years |

John R. Nolan

Age: 58 | | |

Kristina A. Curtis

Age: 61

| | President since 2005;

and Treasurer since 2008 and

from 1991-20052018 | | | Senior Vice President of Finance and Operations (since 2002),and Treasurer, and Director (since 1991), Senior Vice President (since 1991), Green Century Capital Management, Inc. (since 2018); Chief Operations Officer, SIFF Capital Management (2016 - 2017); Partner, Kingsbridge National Ice Center (2009 – 2016). |

| | | | | | |

Age: 5562 | | | Chief Compliance Officer since 2004; Secretary and Assistant Treasurer since 2006 | | | Chief Compliance Officer, (since 2004); Clerk and Director (since 2006), Green Century Capital Management, Inc. |

TABLE OF CONTENTS

Trustee Nominees’ Biographies and Qualifications

The Trustees are experienced business people, attorneys and non-profit organization managers who meet periodically throughout the year to oversee the Funds’ activities, review contractual arrangements with companies that provide services to the Funds, oversee management of the risks associated with such activities and contractual arrangements, and review the Funds’ performance and expenses, among other reviews and assessments. In determining that a particular Trustee was and continues to be qualified to serve as a Trustee, the Board has considered a variety of criteria, none of which, in isolation, was controlling. The Board believes that, collectively, the individual Trustees have balanced and diverse experience, qualifications, attributes, and skills, which allow the Board, as a whole, to operate effectively in governing the Funds and protecting the interests of shareholders. In addition, each Trustee is committed to the Funds’ and Green Century’s mission of offering environmentally responsible and fossil fuel free mutual funds and advocating for greater corporate environmental accountability. Information about the specific experience, skills, attributes, and qualifications of each Trustee, which in each case led to the Board’s conclusion that the Trustee should serve (or continue to serve) as a trustee of the Funds, is provided in the table above, and in the following paragraphs. References to experience, qualifications, attributes and/or skills of Trustees do not constitute holding out the Board or any Trustee as having special expertise or experience, and shall not impose any greater responsibility or liability on any Trustee or on the Board by reason thereof.

Jonathan Darnell

is the founder and owner of a private placement firm, specializing in the alternative energy and biomedical sectors. He is also a Managing Director of a firm specializing in investments in alternative energy and related enterprises. Previously he was a Vice President at Morgan Stanley in Private Wealth Management, the Firm’s ultra-high net worth division, where he provided investment advice and portfolio management services across all asset classes for clients with combined total capital exceeding five billion dollars. Prior to that, he served in various senior management and board capacities at the Public Interest Network of environmental and citizen advocacy organizations. Mr. Darnell has served as a Trustee of the Funds since 2014.

Mr. Darnell’s qualifications to serve as a Trustee include his extensive experience in the investment industry as well as his many years of involvement in public policy and commercial aspects of renewable power generation and resource conservation.

Laurie Moskowitz

Daniel S. Kern is currently the Senior Director for Campaigns, U.S. & Canada, for The ONE Campaign. SheChief Investment Officer of TFC Financial Management and is responsible for creating high impact campaignsoverseeing TFC's investment

TABLE OF CONTENTS

process, research activities and portfolio strategy. Mr. Kern chairs the firm's Investment Committee. Prior to

secure publicjoining TFC in 2015, he was the President and

political supportChief Investment Officer at Advisor Partners, a boutique asset manager that manages equities and asset allocation products for

overseas development assistance fromadvisors, financial institutions and family offices. He was responsible for management of the

U.S. Governmentfirm including oversight of sales, client services and operations. Mr. Kern is a CFA Charterholder and a former president of the CFA Society of San Francisco. He is a Board member and Chair of the Investment Committee for the Cambridge Community Foundation, on the Board of Advisors for the Brandeis International Business School, and on the Board of Directors of Wealthramp. Mr. Kern is a contributor to US News & World Report and ThinkAdvisor.com, a regular guest on Bloomberg's Baystate Business and a frequent speaker at regional, national and international

multi-lateral institutions.Previously, she was the founder and principal partner of FieldWorks,investment forums. Mr. Kern has served as a campaign planning firm, managing all aspectsTrustee of the business, including marketing and promotion, project development, client relations, budget oversight, administration, legal and human resources. Prior to that, she worked for the Democratic National Committee and various political campaigns.

Ms. Moskowitz’sFunds since 2015.

Mr. Kern's qualifications to serve as a Trustee include herhis extensive portfolio and other management experience, including his experience working with other mutual fund boards.

Peter D. Kinder Peter D. Kinder co-founded what became KLD Research & Analytics, Inc. in 1988 and served as an organizational leader, strategic thinker, managerits President until its sale in 2009 to Risk Metrics Group (now owned by MSCI). In 1990, the company created the first index to gauge the performance of SRI (Socially Responsible Investing) portfolios – the Domini/KLD 400. Mr. Kinder was also a co-founder (1991) and business owner as well as her historyprincipal (1997-2000) of campaign work.Bancroft Poor is currently the Vice PresidentDomini Social Investments, LLC, a mutual fund company. Among his books are: Ethical Investing (1984); The Social Investment Almanac (1992); and Investing for Operations, the Chief Financial Officer and an Assistant Treasurer for the Massachusetts Audubon Society. He is in charge of all of Mass Audubon’s financial, administrative, information technology, human resources, and capital assets and planning functions. Previously, he was the Finance Director for the Massachusetts Public Interest Research Group and prior to that, worked in research and management consulting positions.Good (1993). He has beenpublished numerous articles and white papers on legal issues affecting SRI, the evolving nature of the corporation, and fiduciary duties of boards. He has spoken at events on four continents. He has received numerous awards, including the Joan Bavaria Award for Building Sustainability into the Capital Markets (2011) and the First Affirmative Financial Network SRI Service award (1992). Among others, he has served on the boards of the Vermont Community Foundation (2011-20) and continues to serve on its investment committee and The Bennington (VT) Museum (2019 to date) and on its Investment and Governance committees. Mr. Kinder has served as a Trustee of the Funds and has served as the Chair of the Funds’ Audit Committee, since 2014. He also currently serves on the Funds’ Valuation Committee.

2015.

Mr. Poor’sKinder’s qualifications to serve as a Trustee include his finance, administrationdecades long experience with sustainable investing, including his ground breaking work with KLD in creating the first index to measure SRI performance, and project management expertisehis experience working with the board of a mutual fund group. He has studied, researched and worked on board governance since the mid-1980s.

TABLE OF CONTENTS

Sanford Pooler is the Deputy Town Manager/Finance Director for the Town of Arlington MA. Previously, he worked in the Town of Amherst MA as wellFinance Director and in the City of Newton MA as Chief Administrative Officer and as Chief Budget Officer. He also worked as committee legal counsel in the Massachusetts House of Representatives. He is a graduate of Dartmouth College and holds a JD from UCLA School of Law and a Masters in Public Administration from the Harvard Kennedy School of Government. He currently teaches a course on Public Budgeting and Finance at the McCormack School of Public Policy at UMass Boston. He is a member of the Massachusetts Municipal Managers Association, a member of and past president of the Massachusetts Government Finance Officers Association and serves as a member of the Fiscal Policy Committee of the Massachusetts Municipal Association.

Mr. Pooler’s qualifications to serve as a Trustee include his extensive experience as a

seniorfinancial manager

or board member for several non-profit and

environmental organizations.analyst as well as his experience in budgeting and accounting.

Mary Raftery

is currently the Senior Advisor, Funder Collaborations, at ClimateWorks Foundation, which supports public policies that are designed to address climate change. She is also a self-employed Organizational Development Consultant. She previously served as the Chief Operating Officer and as the Director of Major Donor Development and Special Projects at two national non-profitnon- profit organizations promoting a green economy. SheMs. Raftery has been a Trustee of the Funds and has served on the Funds’ Qualified Legal Compliance Committee, since 2009. She also currently serves on the Funds’ Nominating Committee.Ms. Raftery’s qualifications to serve as a Trustee include her extensive experience in non-profit management, as well as her work on environmental issues with labor unions, businesses, environmental groups and foundations in the U.S. and Europe.

James

H. Starr

is the founderfounded, owned and owner ofserved as a Senior Attorney at a law firm in Colorado andfor over thirty years. He is also thea Director and the President of the Gunnison Valley Housing Foundation and thea Director and Vice President of the CoolCoal Creek Watershed Commission,Coalition, both based in Colorado. He has participated in and served on numerous community service organizations and boards for over thirty years. He served as a town councilperson and county commissioner for over 18 years. Mr. Starr has been a Trustee of the Funds since the Funds’ inception in 1991 and has served as the Independent Chairperson of the Board of Trustees since 2009. He also currently serves on the Funds’ Audit, Nominating and Qualified Legal Compliance Committees.Mr. Starr’s qualifications to serve as a Trustee of the Funds include his long experience as a lawyer and small business owner and his work as an elected official and on numerous community service activities and service on many community boards for over 30forty years.

TABLE OF CONTENTS

John Comerford

Thomas Subak is currently an Executive Managing DirectorIndependent Consultant with Tom Subak LLC where he performs digital transformation consulting with leading national organization leaders, boards and funders. Prior to founding Tom Subak LLC, he was an Independent Consultant and Chief Partnership Officer at Catchafire where he developed and executed a proactive strategy to enhance the organization’s brand and revenue. He worked for the Planned Parenthood Federation of Instinet, oneAmerica for several years in a variety of the largest brokers in the electronic trading market. He has served as a portfolio manager and equity trader and has led thesenior positions where his work included development of securities trading software products. He holdsnational strategies for the professional accreditationorganization and expansion of a Certified Financial Analyst. He has been a Trustee of the Funds since 2005 and has served on the Funds’ Valuation Committee since 2007.its digital reach.

Mr.

Comerford’sSubak’s qualifications to serve as a Trustee include his

over 20 years ofextensive experience

in the securities, financial serviceswith organizational development, digital marketing and

brokerage industries and his ability to offer counsel on investment matters.solving complicated marketing challenges.

Douglas

H. Phelps

is President and Executive DirectorCEO of the Public Interest Network, a foundry for change organizations. He also Chairs the Boardfamily of U.S. PIRG, the federation of State PIRGs, and Chairs the Advisory Board of the Fund for the Public Interest, a national non-profit that runs grass-roots campaigns to raise money, sign up members, educate the public and build political support for some of the nation’s leading public interestnon-profits such as the PIRGs,organizations, including Environment America and the Human Rights Campaign. Mr. Phelps chairs the board ofPublic Interest Research Group (PIRG), and their state affiliates in 30 states, as well as Green Corps, the field school for environmental organizing, and serves on the Board of the National Environmental Law Center.Center, and Environmental Action. Mr. Phelps conceived of, and co-founded, the Green Century Funds. He has served as a Trustee of the Funds since 1997. He also has served as President (1996 to 2003)1997 and Director (since 1996) of Green Century.

Century Capital Management since 1996. He is a graduate of Colorado State University and the Harvard Law School

.Mr. Phelps’ qualifications to serve as a Trustee of the Funds include his long tenure with Green Century and his extensive experience as

aan executive, board member or chair of several non-profit and environmental organizations.

Wendy Wendlandt

is the Political Director forhas worked with The Public Interest Network. OverNetwork, a family of several dozen organizations working for social change in the last 30 years,United States, since 1984, currently serving as a Senior Vice President. She also is the Acting President of Environment America. During her time with the Public Interest Network, she has helped secure millionsbuilt and run organizations as well as directed campaigns on numerous issues, including renewable energy, stopping the proliferation of dollars in foundation grants, expand the breadthgenetically engineered food, nuclear and depth of coalitions around issues ranging fromtoxic waste pollution, and campaign finance reform to genetically engineered foods, and playreform. The Public Interest Network started as a lead role in campaigns that have won dozenscollaboration of tangible results for public health and the environment.state PIRG organizations, several of which are owners of Green Century. Ms. Wendlandt has served as a Trustee of the Funds since the Funds’ inception in 1991 and has also served as President (2006-2013) and Director (since 2006) of Green Century.Ms. Wendlandt’s qualifications to serve as Trustee of the Funds include her executive management experience with non-profit organizations and her long collaboration with Green Century.

TABLE OF CONTENTS

Trustee Oversight Responsibilities

The Chairperson of the Board of Trustees of the Funds is an Independent Trustee, as defined in the 1940 Act.

HeThe Chairperson presides at meetings of the Board and at executive sessions of the Independent Trustees. The Independent Chairperson is appointed by a majority of the Independent Trustees. It is the policy of the Board that the Independent Chairperson of the Board, with full responsibilities as a chairperson would generally have, will continue to be an Independent Trustee. The Board of Trustees has determined that having its Chairperson be an Independent Trustee is in the best interests of the Funds’ shareholders.

The Board has

fourfive standing committees, described in more detail below. Through the committees, particularly the Audit Committee, the Independent Trustees consider and address important matters involving the Funds, including those presenting conflicts or potential conflicts of interest with management. The Board has determined that delegation to the committees of specified oversight responsibilities helps ensure that the Funds have effective independent governance and oversight. The Board has determined that its leadership and committee structure is appropriate given Green Century’s role with respect to the Funds’ investment and business operations. The Board believes that the leadership and committee structure

providesprovide effective management for the relationships between the Funds, Green Century and the Funds’ other principal service providers, and facilitates the exercise of the Board’s independent judgment in evaluating and managing the relationships.

Like other mutual funds, the Funds are subject to risks, including investment, compliance, operational and valuation risks, among others. The Board oversees risk as part of its oversight of the Funds. Risk oversight is addressed as part of various Board and committee activities. The Board, directly or through its committees, interacts with and reviews reports from, among others, the Funds’ investment adviser and administrator, Green Century, the Funds’ Chief Compliance Officer (CCO), the Funds’ investment subadvisers, and the Funds’ independent registered public accounting firm, as appropriate, regarding risks faced by the Funds and risk management.

The Board has designated the CCO to be responsible for the Funds’ compliance policies and procedures. The CCO reports to the Independent Trustees of the Board and is responsible for delivering, at least annually, a written report on compliance and other required or agreed on matters to the Board. The Independent Trustees of the Board also meet with the CCO, separately from management, generally at least annually, to address compliance issues and other relevant matters.

TABLE OF CONTENTS

The actual day-to-day risk management functions with respect to the Funds are subsumed within the responsibilities of the investment adviser and administrator, the subadvisers, and other service providers, depending upon the nature of the risk. In the course of its interactions with the various service providers, the Board has emphasized the importance of maintaining vigorous risk management programs and procedures. The Trustees recognize that not all risks that may affect the Funds can be identified. Processes and controls developed cannot eliminate or mitigate the occurrence or effects of all risks, and some risks may be simply beyond any processes, procedures or controls of the Board, the Funds, Green Century, or other service providers. As a result of the foregoing and for other reasons, the Board’s risk management oversight is subject to substantial limitations.

Compensation of Trustees

No Trustee

The Independent Trustees of the Funds receives any compensation fromreceive an annual retainer for serving as a Trustee in the Funds, butamount of $5,000. In addition, each Trustee is reimbursed for any out-of-pocket expenses incurred in attending meetings of the Board of Trustees or of any committee thereof. Information regarding compensation paid to the Trustees of the Funds for the fiscal year ended July 31, 20132020 is set forth below. The Funds do not contribute to a retirement plan for the Trustees of the Funds. The Officers do not receive any direct remuneration from the Funds.

Independent Trustees:

| | | | | | | | | | | | | | | | | | |

Jonathan Darnell | | | $1,667 | | | $1,666 | | | $1,667 | | | None | | | None | | | $5,000 |

Daniel S. Kern | | | $1,667 | | | $1,666 | | | $1,667 | | | None | | | None | | | $5,000 |

Peter D. Kinder | | | $1,667 | | | $1,666 | | | $1,667 | | | None | | | None | | | $5,000 |

Mary Raftery | | | $1,667 | | | $1,666 | | | $1,667 | | | None | | | None | | | $5,000 |

James H. Starr | | | $1,667 | | | $1,666 | | | $1,667 | | | None | | | None | | | $5,000 |

Interested Trustees:

| | | | | | | | | | | | | | | | | | |

Douglas H. Phelps | | | None | | | None | | | None | | | None | | | None | | | None |

Wendy Wendlandt | | | None | | | None | | | None | | | None | | | None | | | None |

TABLE OF CONTENTS

| | | | | | | | |

Name of Person, Position

| | Aggregate

Compensation from

the Funds

| | Pension or

Retirement Benefits

Accrued as Part of

Funds Expenses | | Estimated Annual

Benefits Upon

Retirement | | Total Compensation

from Funds and

Green Century

Fund Complex Paid

to Trustees |

Independent Trustees:

|

| | | | |

Mary Raftery

| | None | | None | | None | | None |

| | | | |

James H. Starr

| | None | | None | | None | | None |

|

Interested Trustees:

|

| | | | |

John Comerford

| | None | | None | | None | | None |

| | | | |

Douglas H. Phelps

| | None | | None | | None | | None |

| | | | |

Wendy Wendlandt

| | None | | None | | None | | None |

Fund Shares Owned by Trustee Nominees

The following table shows the amount of equity securities beneficially owned by each Nominee in the Green Century Family of Funds as of

June 30, 2014.December 31, 2020.Name of Trustee Nominee | | | Dollar Range of

Equity Securities

in Fund/Fund Name | | | Aggregate Dollar Range

of Equity Securities in Fund/Fund Name

| | Aggregate Dollar

Range of Equity

Securities in all

Investment

Companies

|

Independent Trustees:

| | | | | | |

Independent Nominees:

Jonathan Darnell | | | None | | | None |

Daniel S. Kern | | | None | | | None |

Jonathan Darnell

Peter D. Kinder | | None | None/Green Century Balanced Fund | None | | |

| | | Over $100,000/Green Century Equity Fund | | | |

Laurie Moskowitz

| | None | Over $100,000/Green Century International Fund | None | | Over $100,000 |

Sanford Pooler | | | $10,001-$50,000/Green Century Balanced Fund | | | |

Bancroft R. Poor

| | None | | None |

| | |

Mary Raftery

| | None | | None |

| | |

James H. Starr

| | $10,001-$50,000/Green Century Equity Fund | | | |

| | | None/Green Century International Fund | | | $10,001-$50,000 |

Mary Raftery | | | None | | | None |

James H. Starr | | | $10,001-$50,000/Green Century Balanced Fund | | $10,001-$50,000 |

| | | | | |

Name of Trustee Nominee

| | Dollar Range of Equity Securities in

Fund/Fund Name

| | Aggregate Dollar

Range of Equity

Securities in all

Investment

Companies

Overseen by

Nominee in

Green Century

Fund Family

|

| | |

Interested Nominees:

| | | | |

| | |

John Comerford

| | None | | None |

| | |

Douglas H. Phelps

| | over $100,000/Green Century Equity Fund

over $100,000/Green Century Balanced Fund

| | over $100,000 |

| | |

Wendy Wendlandt

| | $10,001-$50,000/Green Century Equity Fund | | | |

| | | $10,001-$50,000/Green Century International Fund | | | $50,001-$100,000 |

Thomas Subak | | | None | | | None |

Interested Trustees: | | | | | | |

Douglas H. Phelps | | | Over $100,000/Green Century Balanced Fund | | | |

| | | Over $100,000/Green Century Equity Fund | | | |

| | | $1-$10,000/Green Century International Fund | | | Over $100,000 |

Wendy Wendlandt | | | $10,001-$50,000/Green Century Balanced Fund | | | |

| | | $10,001-50,001-$50,000100,000/Green Century Equity Fund | | | |

| | | None/Green Century International Fund | | | Over $100,000 |

TABLE OF CONTENTS

As of

July 22, 2014,March 31, 2021, none of the current Independent Trustees of the Funds or nominees for Independent Trustee, or their immediate family members, owned beneficially or of record any securities of Green Century, UMB Distribution Services, LLC (“UMB”), the Funds’ distributor, or any person controlling, controlled by or under common control with Green Century or UMB. “Beneficial ownership” is determined in accordance with Rule 16a-1(a)(2) under the 1934 Act.

As of

July 22, 2014,March 31, 2021, the Trustees, Nominees and Officers of the Funds, individually and as a group, owned beneficially or had the right to vote less than 1% of the outstanding shares of each Fund.

Board Meetings.

During the fiscal year ended July 31, 2013,2020, the Board of Trustees of the Funds met fourfive times. Each Trustee (other than John Comerford and Douglas Phelps) attended at least 75% ofall the meetings during the fiscal year ended July 31, 2013. Bancroft R. Poor was2020. Sanford Pooler and Thomas Subak were not a TrusteeTrustees of the Funds during the fiscal year ended July 31, 2013.2020.

Shareholder communications intended for the Board of Trustees (or one or more specified Trustees) may be sent to them in writing, to the Secretary of the Funds, in care of Green Century Capital Management, Inc., 114 State Street, Suite 200, Boston, MA 02109.

Audit Committee.

Stephen J. Morgan*, Bancroft R. Poor and James H. Starr and Jonathan Darnell, each an Independent Trustee, are members of the Audit Committee. TheUntil June 2020, former Independent Trustee Bancroft Poor was a member of the Audit Committee. Mr. Darnell was elected to the Audit Committee in June 2020.The Audit Committee met once during the Funds’ fiscal year ended July 31, 20132020 to select the auditor, review the Funds’ financial statements and audited annual report, to receive the report of the Funds’ independent auditors, and to review the internal and external accounting procedures of the Funds. Messrs. MorganStarr and StarrPoor attended this meeting. Mr. Poor was not a Trustee of the Funds during the fiscal year ended July 31, 2013.

Nominating Committee. Stephen J. Morgan*, Mary Raftery and James H. Starr, each an Independent Trustee, are members of the Nominating Committee. The Nominating Committee is responsible for, among other things, screening and nominating candidates to serve on the Board of Trustees. The Nominating Committee evaluates candidates’ qualifications for board membership. The Nominating Committee Charter provides that the Committee shall require that candidates for Trustee have a college degree or equivalent business experience.

Further, the Nominating Committee Charter provides that the Committee shall take into account at least the following factors when considering each candidate for Trustee: (i) the availability and commitment of the candidate to attend meetings and perform his or her

TABLE OF CONTENTS

responsibilities on the Board; (ii) the candidate’s relevant experience; (iii) the candidate’s educational background; (iv) the candidate’s ability, judgment and expertise; and

(v) the overall diversity of the Board’s composition. The Committee does not have a formal procedure for the implementation, or for assessing the effectiveness, of its policy with regard to the consideration of diversity on the Board in reviewing potential nominees for Independent Trustee. The Committee will consider and evaluate candidates submitted by shareholders of the Funds on the same basis as it considers and evaluates candidates recommended by other sources. Shareholder recommendations should be delivered in writing to the Secretary of the Funds, c/o Green Century Capital Management, Inc. The Nominating Committee did not meet during the Funds’ fiscal year ended July 31, 2013.2020. The Nominating Committee met ninefour times during the period from August 1, 20132020 through June 30, 2014.March 16, 2021. Mr. Morgan attended eight of these meetings, Mr. Starr attended all of these meetings and Ms. Raftery each attended eightall of these meetings. A copy of the Nominating Committee Charter is attached to this Proxy Statement as Exhibit A.

Valuation Committee.

John ComerfordPeter D. Kinder and Bancroft R. PoorJonathan Darnell are members of the Valuation Committee. The Valuation Committee monitors the valuation of fund investments. The Valuation Committee did not meet during the most recent fiscal year.

Qualified Legal Compliance Committee.

Stephen J. Morgan*, James H. Starr, and Mary Raftery and Peter D. Kinder, each an Independent Trustee, are members of the Qualified Legal Compliance Committee (“QLCC”) of the Board of Trustees of the Funds. The QLCC is authorized to receive, evaluate and investigate reports of material violations of law as prescribed by Section 307 of the Sarbanes-Oxley Act of 2002, which shall include, without limitation, the authority to retain such legal counsel and expert personnel as the QLCC may deem necessary and to notify the SEC in the event the Funds fail to implement a recommendation of the QLCC following an investigation. The QLCC did not meet during the most recent fiscal year.* Mr. Morgan is retiring from the Board effective the date

Investment Oversight Committee. Jonathan Darnell, Daniel S. Kern and Peter D. Kinder, each an Independent Trustee, are members of the shareholder meeting, including adjournments.Investment Oversight Committee (“IOC”). The IOC oversees the Funds’ subadvisers and reviews the performance of the Funds. In addition, the IOC may discuss possible enhancements to the Funds, and/or new fund or product development, and may review the current regulatory landscape and any impacts it may have on the Funds. The IOC met three times during the most recent fiscal year.

TABLE OF CONTENTS

Nomination by the Nominating Committee and the Board of Trustees

At a meeting of the Board’s Nominating Committee held on

June 23, 2014,March 16, 2021 the Committee nominated Jonathan Darnell,

Laurie Moskowitz, Bancroft R. Poor,Daniel S. Kern, Peter D. Kinder, Sanford Pooler, Mary Raftery,

and James H. Starr

and Thomas Subak to serve as Independent Trustees of the Funds and

John Comerford, Douglas H. Phelps and Wendy Wendlandt to serve as Interested Trustees of the Funds. The Nominating Committee considered the criteria set forth in the Nominating Committee Charter, as described above under “Nominating Committee”, in nominating the Nominees for election or

re-electionre- election as applicable, as Trustees. With respect to each new Independent Trustee Nominee, Green Century recommended the Nominee. At the

June 25, 2014March 24, 2021 meeting, the Board, including the Independent Trustees, agreed that each Nominee Trustee of the Funds should be submitted to shareholders for approval and voted to nominate such Nominees and recommend election of the Nominees by the shareholders of the Funds.

The affirmative vote of a plurality of votes cast, voted in person or by proxy at the Special Meeting, is required for the election of each Nominee to the Board of Trustees of the Funds.

If you sign and return your proxy but give no voting instructions, your shares will be voted

FORall Nominees named herein.

The Board of Trustees recommends that you vote FOR the election of

each of the Nominees to the Board.

The management of the Funds knows of no other business to be presented at the Meeting. If any additional matters should be properly presented, it is intended that the enclosed proxy will be voted in accordance with the judgment of the persons named in the enclosed form of proxy.

TABLE OF CONTENTS

PART 4. INFORMATION REGARDING THE FUNDS.

Interests of Certain Persons

As of the July 22, 2014,March 31, 2021, to the best knowledge of the Funds, the following persons owned of record 5% or more of the outstanding shares of each class of the Funds:

Green Century Balanced Fund Individual Investor Class

| | | | | | |

National Financial Services Corporation

200 Liberty Street, 5th Floor, New York, NY 10281* | | | 1,755,909.466 | | | 19.96% |

Charles Schwab & Company

211 Main Street, San Francisco, CA 94105* | | | 1,370,615.895 | | | 15.58% |

| | | | | | |

Green Century Balanced Fund Institutional Class

| | | | | | |

National Financial Services Corporation

200 Liberty Street, 5th Floor, New York, NY 10281* | | | 498,428.077 | | | 24.22% |

Charles Schwab & Company

211 Main Street, San Francisco, CA 94105* | | | 262,432.273 | | | 12.75% |

ETrade Savings Bank

P.O. Box 6503, Englewood, CO 80155* | | | 132,333.666 | | | 6.43% |

LPL Financial

4707 Executive Drive, San Diego, CA 92121* | | | 130,394.340 | | | 6.34% |

Wells Fargo Clearing Services

2801Market Street, St. Louis, MO 63103* | | | 123,498.364 | | | 6.00% |

| | | | | | |

Green Century Equity Fund Individual Investor Class

| | | | | | |

Charles Schwab & Company

211 Main Street, San Francisco, CA 94105* | | | 1,119,578.242 | | | 23.15%. |

National Financial Services Corporation

200 Liberty Street, 5th Floor, New York, NY 10281* | | | 823,320.555 | | | 17.03% |

TD Ameritrade

P.O. Box 2226, Omaha, NE 68103* | | | 268,550.787 | | | 5.55% |

| | | | | | |

Green Century Equity Fund Institutional Class

| | | | | | |

Charles Schwab & Company

211 Main Street, San Francisco, CA 94105* | | | 698,752.533 | | | 30.55% |

National Financial Services Corporation

200 Liberty Street, 5th Floor, New York, NY 10281* | | | 551,814.247 | | | 24.13% |

LPL Financial

4707 Executive Drive, San Diego, CA 92121* | | | 221,814.812 | | | 9.70% |

SEI Private Trust Company

One Freedom Valley Drive, Oaks, PA 19456* | | | 173,875.391 | | | 7.60% |

| | | | | | |

Green Century International Index Fund Individual Investor Class

| | | | | | |

Charles Schwab & Company

211 Main Street, San Francisco, CA 94105* | | | 1,140,978.802 | | | 39.73% |

TABLE OF CONTENTS

| | | | | | | | |

Record Owner | | Number of

Shares | | | Percent of

Shares | |

| | |

Green Century Balanced Fund | | | | | | | | |

| | |

Charles Schwab & Company

101 Montgomery Street, San Francisco, CA 94104* | | | 1,098,119.314 | | | | 21.52 | % |

| | |

National Financial Services Corporation

200 Liberty Street, 5th Floor, New York, NY 10281* | | | 721,584.846 | | | | 14.14 | % |

| | |

Mac and Company

525 William Penn Place, Pittsburgh, PA 15230* | | | 311,113.822 | | | | 6.10 | % |

| | |

Green Century Equity Fund | | | | | | | | |

| | |

Charles Schwab & Company

101 Montgomery Street, San Francisco, CA 94104* | | | 975,314.602 | | | | 31.08 | % |

| | |

National Financial Services Corporation

200 Liberty Street, 5th Floor, New York, NY 10281* | | | 409,960.179 | | | | 13.06 | % |

| | |

TD Ameritrade

P.O. Box 2226, Omaha, NE 68103*... | | | 166,211.370 | | | | 5.30 | % |

*Owners of record, not beneficial owners

| | | | | | |

National Financial Services Corporation

200 Liberty Street, 5th Floor, New York, NY 10281* | | | 422,902.727 | | | 14.73% |

| | | | | | |

Green Century International Index Fund Institutional Class

| | | | | | |

Charles Schwab & Company

211 Main Street, San Francisco, CA 94105* | | | 3,917,968.127 | | | 56.66% |

National Financial Services Corporation

200 Liberty Street, 5th Floor, New York, NY 10281* | | | 1,093,658.127 | | | 15.82% |

TD Ameritrade

P.O. Box 2226, Omaha, NE 68103* | | | 671,549.045 | | | 9.71% |

Paradigm Partners

1543 Wazee Street, Denver, CO 80202 | | | 535,492.091 | | | 7.74% |

*

| Owners of record, not beneficial owners |

Independent Registered Public Accounting Firm

The Board has selected KPMG LLP (“KPMG”) to serve as the independent public accountant for each Fund. Representatives of KPMG are not expected to be present at the Special Meeting, but will have the opportunity to make a statement if they wish, and will be available by telephone to respond to appropriate questions.

Accounting Fees and Services for the Trust

The information under each of the subheadings below show the aggregate fees KPMG billed to the Trust and the Adviser for its professional services rendered for the Funds’ most recently completed fiscal

years.years

Audit Fees

. The aggregate fees billed for each of the last two fiscal years for professional services rendered by KPMG for the audit of the Funds’ annual financial statements or services that are normally provided by KPMG in connection with statutory and regulatory filings or engagements for those fiscal years are set forth below:For the fiscal year ended July 31,

2013: $37,400.002020: $83,000.00

For the fiscal year ended July 31,

2012: $36,400.002019: $83,000.00

Audit-Related Fees. There were no fees billed for the Funds’ two most recently completed fiscal years for assurance and related services by the principal accountant that are reasonably related to the performance of the audit of the Funds’ financial statements and are not reported under theAudit Feescaption above.

TABLE OF CONTENTS

Tax Fees

. The aggregate fees billed in each of the last two fiscal years for professional services rendered by KPMG for tax compliance, tax advice and tax planning are set forth below. The services comprising the fees disclosed under this category are tax compliance monitoring and tax filing preparation.For the fiscal year ended July 31,

2013: $10,800.002020: $18,540.00

For the fiscal year ended July 31,

2012: $10,400.002019: $18,540.00

All Other Fees. There were no other fees billed for the Funds’ two most recently completed fiscal years for products and services provided by KPMG, other than the services reported under theAudit Fees,,Audit-Related Fees,,orTax Fees captions above.

TABLE OF CONTENTS

Aggregate Non-Audit Fees

. The aggregate non-audit fees billed by KPMG for services rendered to the Funds were the tax compliance, tax advice and tax planning fees listed in theTax Fees caption above and are set forth below. No non-audit fees were billed by KPMG for services rendered to the Funds’ investment adviser or any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the Funds for the last two fiscal years of the Funds.For the fiscal year ended July 31,

2013: $10,800.002020: $18,540.00

For the fiscal year ended July 31,

2012: $10,400.002019: $18,540.00

Audit Committee Pre-Approval Policies and Procedures

The Charter of the Audit Committee of the Board requires that the Committee approve (a) all audit and permissible non-audit services to be provided to the Funds and (b) all permissible non-audit services to be provided by the Funds’ independent auditors to the Funds’ investment adviser or administrator or any entity controlling, controlled by, or under common control with the Funds’ investment adviser or administrator that provides ongoing services to the Funds, if the engagement relates directly to the operations and financial reporting of the Funds. The Audit Committee has the duty to consider whether the non-audit services provided by the Funds’ auditor to the Funds’ investment adviser, administrator, or any adviser affiliate that provides ongoing services to the Funds, which services were not pre-approved by the Audit Committee, are compatible with maintaining the auditor’s independence and to review and approve the fees proposed to be charged to the Funds by the auditors for each audit and non-audit service.

There were no services described above (including services required to be approved by the Audit Committee pursuant to paragraph (c)(7)(ii) of Rule 2-01 of Regulation S-X) that were approved by the Audit Committee pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X. None of the hours expended on the principal accountant’s engagement to audit the Funds’ financial statements for the fiscal year ended July 31, 20132020 were attributable to work performed by persons other than the principal accountant’s full-time, permanent employees.

TABLE OF CONTENTS

Each Fund is a series of the Green Century Funds (the “Trust”), a diversified, open-end registered investment company organized as a Massachusetts business trust under a Declaration of Trust dated as of July 1, 1991. The Balanced Fund was designated as a separate series of the Trust on July 1, 1991. The Equity Fund was designated as a separate series of the Trust on April 7, 1995. The

International Fund was designated a separate series of the Trust on June 29, 2016. The mailing address of the Trust is 114 State Street, Suite 200, Boston, MA 02109.

Green Century is the Funds’ investment adviser and administrator. Trillium Asset Management LLC serves as the subadviser for the Green Century Balanced Fund. The principal business address of Trillium Asset Management LLC is Two Financial Center, 60 South Street, Suite 1100, Boston, MA 02111. Northern Trust Investments, Inc. serves as the subadviser for the Green Century Equity

Fund and the Green Century International Fund. The principal business address of Northern Trust Investments, Inc. is 50 South LaSalle Street, Chicago, IL 60603. UMB

Distribution Services is the Funds’ distributor. The principal business address of UMB

Distribution Services is 235 West Galena Street, Milwaukee, WI 53212.

Huntington AssetAtlantic Shareholder Services,

Inc.LLC acts as transfer agent and dividend disbursing agent for each Fund. The principal business address of

Huntington AssetAtlantic Shareholder Services,

Inc.LLC is

2960 North Meridian, Suite 300, Indianapolis, IN 46208. State StreetThree Canal Plaza, Portland, ME 04101. UMB Bank,

and Trust Company (State Street)n.a. acts as the custodian for each of the Funds.

State Street’sUMB Bank, n.a,’s principal business address is

One Lincoln Street, Boston, Massachusetts 02111.928 Grand Boulevard, Kansas City, MO 64106.

Shareholders Sharing the Same Address

If two or more shareholders share the same address, only one copy of this proxy statement may be delivered to that address, unless the Trust has received contrary instructions from one or more of the shareholders at that shared address. Upon written or oral request, the Trust will promptly deliver a separate copy of this proxy statement to a shareholder at a shared address. Please note that each shareholder (other than joint account shareholders) will receive a separate proxy card, regardless of whether he or she resides at a shared address. Please call 1-800-221-5519 or forward a written request to the Trust at Green Century Funds, PO Box 6110, Indianapolis, IN 46206-6110588, Portland, ME 04112 if you would like to (1) receive a separate copy of this proxy statement; (2) receive your annual reports or proxy statements separately in the future; or (3) request delivery of a single copy of annual reports or proxy statements if you are currently receiving multiple copies at a shared address.

TABLE OF CONTENTS

Submission of Certain Proposals

The Trust is a Massachusetts business trust and as such is not required to hold annual meetings of shareholders, although special meetings may be called for the Funds, for purposes such as electing Trustees or removing Trustees, changing fundamental policies, or approving an advisory contract. Shareholder proposals to be presented at any subsequent meeting of shareholders must be received by the Trust at the Trust’s office within a reasonable time before the proxy solicitation is made.

|

| | | By Order of the Board of Trustees, |

| | | |

| | | Amy Puffer, Secretary |

| | | |

| | | April 8, 2021 |

August 12, 2014TABLE OF CONTENTS

Nominating Committee Charter

1.

| The Nominating Committee (the “Committee”) of the Board of Trustees (the “Board” or the “Board of Trustees”) of the Green Century Funds (the “Trust” or the “Funds”) shall be composed entirely of Independent Trustees, none of whom shall be an “interested person” of the Funds, as that term is defined in Section 2(a)(19) of the Investment Company Act of 1940. The Committee shall be comprised of as many Independent Trustees as the Board shall determine, but in no event fewer than two (2) Independent Trustees. The Board may remove or replace members of the Committee for any reason by majority vote of the Independent Trustees of the Board. |

2.

| The primary purpose and responsibility of the Nominating Committee is the screening and nomination of candidates to serve on the Board of Trustees (each, a “Candidate”). |

3.

| To carry out its purposes, the Committee shall have the authority and responsibility to determine the minimum qualifications that a Candidate is required to have and the factors that the Committee will consider in reviewing Candidates. Presently, the Committee has determined to: |

| a.

| require that Candidates have a college degree or equivalent business experience; |

| b.

| take into account at least the following factors when considering each Candidate: |

| i.

| the availability and commitment of the Candidate to attend meetings and perform his or her responsibilities on the Board; |

| ii.

| the Candidate’s relevant experience; |

| iii.

| the Candidate’s educational background; |

| iv.

| the Candidate’s ability, judgment and expertise; and |

| v.

| the overall diversity of the Board’s composition; and |

| c.

| consider Candidates recommended by one or more of the following sources: |

| i.

| the Trust’s current Trustees; |

TABLE OF CONTENTS

| iii.

| the Trust’s investment adviser or sub-adviser; |

| iv.

| shareholders of either Fund (see below); and |

any other source the Committee deems appropriate.

4.

| The Committee may, but is not required to, retain a third party search firm at the Trust’s expense to identify potential Candidates. |

5.

| The Committee will consider and evaluate Candidates submitted by shareholders of the Funds on the same basis as it considers and evaluates Candidates recommended by other sources. Shareholder recommendations should be delivered in writing to the Secretary of the Trust, c/o Green Century Capital Management, Inc. |

6.

| Meetings of the Committee will follow the following procedures: |

| a.

| The Committee will not have regularly scheduled meetings. Committee meetings shall be held as and when the Committee or the Board determines necessary or appropriate in accordance with the Trust’s By-laws. |

| b.

| The Committee may meet either in person or by telephone, and the Committee may act by unanimous written consent, to the extent permitted by law and by the Funds’ organizational documents. |

| c.

| A majority of the members shall constitute a quorum for the transaction of business at any meeting of the Committee. The action of a majority of the members present at a meeting at which a quorum is present shall be the action of the Committee. If the Committee consists of two members then a majority of the Committee will be equal to two members. |

| d.

| The Committee may select one of its members to be its chair. |

| e.

| The Committee shall prepare and retain minutes of its meetings and appropriate documentation of decisions made outside of meetings by delegated authority. |

| f.

| The Committee shall maintain all documents received or reviewed by it for at minimum ten years. |

7.

| This Charter has been adopted and approved by the Board of Trustees of the Funds and may be amended by the Board from time to time in compliance with applicable laws, rules, and regulations. |

June 2005

| | |

PO BOX 55909

BOSTON, MA 02205-5909

| | Your Vote is Important!

Vote by Internet

Please go to the electronic voting site atwww.2voteproxy.com/gcf. Follow the on-line instructions. If you vote by internet, you need not return your proxy card.

Vote by Telephone

Please call us toll free at1-800-830-3542, and follow the instructions provided. If you vote by telephone, you need not return your proxy card.

Vote by Mail

Please complete, sign and date your proxy card and return it promptly in the enclosed envelope.

Please ensure the address below shows through the window of the enclosed postage paid return envelope.

PROXY TABULATOR

PO BOX 55909

BOSTON, MA 02205-9100

|

PROXY

GREEN CENTURY BALANCED FUND

GREEN CENTURY EQUITY FUND

PROXY FOR A SPECIAL MEETINGTABLE OF SHAREHOLDERS TO BE HELD SEPTEMBER 22, 2014

The undersigned, revoking prior proxies, hereby appoints Kristina A. Curtis and Amy F. Puffer, and each of them, proxies with several powers of substitution, to vote for the undersigned at the Special Meeting of Shareholders of the Green Century Balanced Fund and theGreen Century Equity Fund to be held at the offices of Green Century Capital Management, 114 State Street, Boston, MA 02109, on September 22, 2014, or at any adjournment or postponement thereof, upon the following matters as described in the Notice of Special Meeting and accompanying Proxy Statement, which have been received by the undersigned.

When properly executed, this proxy will be voted in the manner directed herein by the undersigned shareholder. The proposal on this proxy card has been proposed by the Green Century Funds Board of Trustees. If no direction is given on the proposal, this proxy card will be voted “FOR” the Proposal. The proxy will be voted in accordance with the holder’s best judgment as to any other matters as may come before the Special Meeting or any adjournments or postponements thereof.

If you choose to vote by mail and you are an individual account owner, please sign exactly as your name appears on the proxy card. Either owner of a joint account may sign the proxy card and the signer’s name must exactly match one of the names that appear on the card.

Please vote, sign where indicated and return promptly in enclosed envelope.

| | | | | | | | |